Getting Started

Prepayments - what is it?

The prepayment is a tax paid in advance for your income. Entrepreneurs usually pay their taxes by prepayments.

Here's How to request prepayment in MyTax

.png?width=1080&height=1080&name=Suomi.fi%20%26%20ennakkoverot%20(1).png)

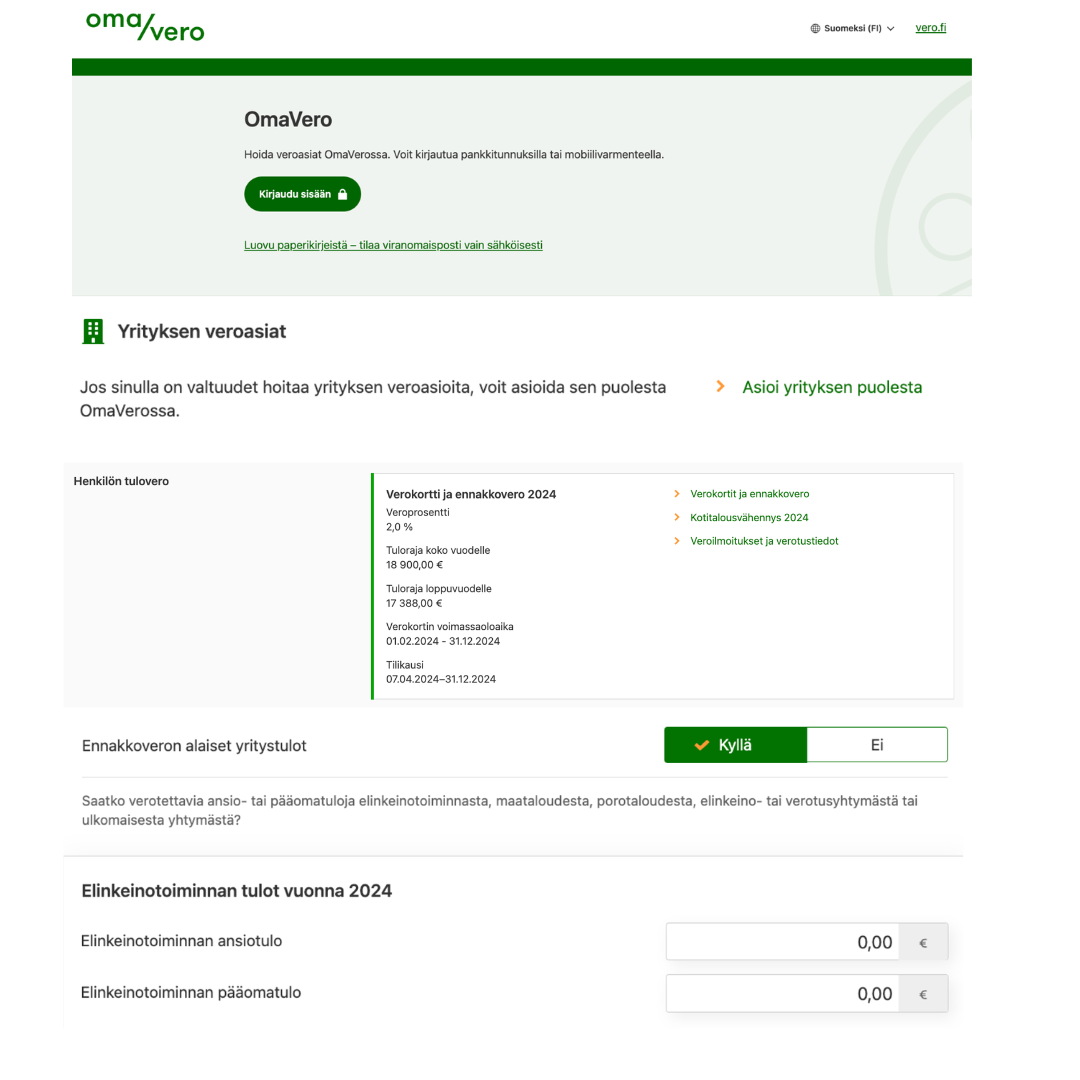

Start filing the request

1. Click the link Tax cards and prepayments in the section under Individual income tax.

2. Click either the Request tax prepayment if there's no prepayments for you yet or Change the prepayment if Tax Administration has already prepared a prepayment calculation for you.

.png?width=1080&height=1080&name=Suomi.fi%20%26%20ennakkoverot%20(1).png)

Evualuate your business income

To file the prepayment request you should be able to evaluate your business income for the year. Your taxable income is your revenue reduced with deductions.

File the request

1. Fill in basic details.

2. In stage Pre-completed income and deductions: You can make changes if needed.

3. Fill your business income to section other income. To enter business income select Yes for Business income subject to prepayments.

4. Stage Other deductions: You can submit other deductions. But don't put your business expenses here, those should be included to your business income.

5. Stage Delivery method: You will receive a new prepayment decision in MyTax once your request has been processed.

6. Preview and send: Check that the details are correct. You can make corrections by clicking Edit or Previous. Once all the details are correct, select Submit.

You will receive a new prepayment decision in MyTax

Once your request has been processed, you will receive a new prepayment decision in MyTax. Please pay the prepayments as indicated in the decision before the due date.

Pricing

Redeem 2 months free with the code: KLETTA2KK

Automated bookkeeping

No manual typing needed

Invoice creation and sending

Ready in just a couple of clicks

Receipt scanning

All stored digitally

VAT and tax reports

Automatically with one click

Mileage log and per diems

Always up-to-date for taxes

All Solo Features

Invoicing, receipts, taxes, mileage log, and more.

Kickoff & Consultation Meetings

Personalized guidance tailored to your needs

Accounting Expert Support

Answers and advice whenever you need them

Tax Expert Support

Make the most of tax benefits and save money

All Solo and Duo Features

All functions plus expert support

Data from the Beginning of the Year

Easy start – with the help of our expert, we import the current year's bookkeeping.

EU Sales Report

A Kletta expert prepares the EU sales summary report.

Periodic reviews

Includes verification of receipts at the end of each VAT period.

Kletta on helpottanut huimasti kirjanpitoani ja asiakkaiden laskutusta siihen vaihdettuani, sillä sovellus on erittäin selkeä ja helppokäyttöinen!

Key Benefits

Kletta is a sole trader’s best friend

Fixed price, no surprise fees

Kletta’s pricing is fully transparent – you only pay a fixed monthly fee. No extra charges for reports or tax filings. You can plan your expenses with confidence and focus on growing your business without unexpected bills.

The easiest accounting app in Finland

Kletta is designed with the everyday life of sole traders in mind. With automated bookkeeping, real-time income tracking, and a user-friendly mobile app, managing your finances is effortless. All essential functions are available right in the app – no complex systems needed.

Reliable and up-to-date

Kletta’s automation ensures your bookkeeping is always current, and tax filings are completed accurately and on time. Our experts continually monitor regulations to keep you compliant at all times.

.png?width=620&height=580&name=Image%20(2).png)

Contact Us

Want to talk to our sales team?

Leave your contact information below, and we’ll get in touch with you!

Frequently Asked Questions

Of course! If you need help, we recommend asking in the Kletta chat first. If you'd like us to handle the request for you, that is possible for a fee of 40€ + VAT.

Yes. That is possible.

You should record paid prepayments in Kletta under the expense category "advance tax".

.png?width=352&height=200&name=image%20(1).png)